Protect Your Team with Comprehensive Group Benefits

Custom disability, life & critical illness coverage that supports employees when they need it most.

Let’s Talk — 720.666.0646

Why Choose Us?

Because We will Tailor it to Your Business

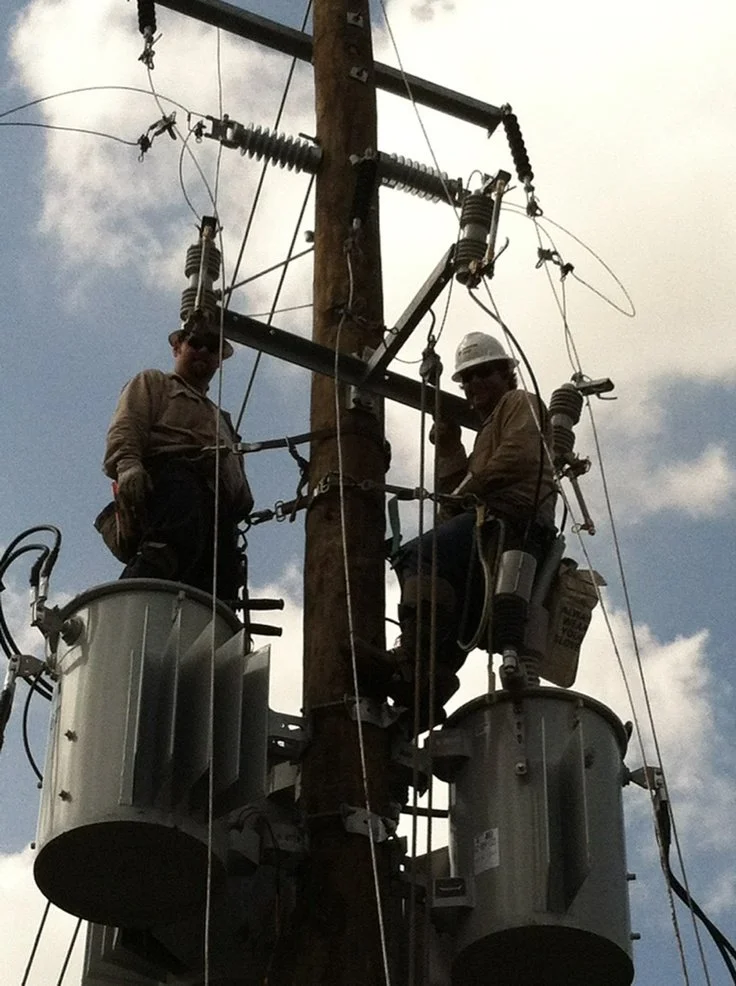

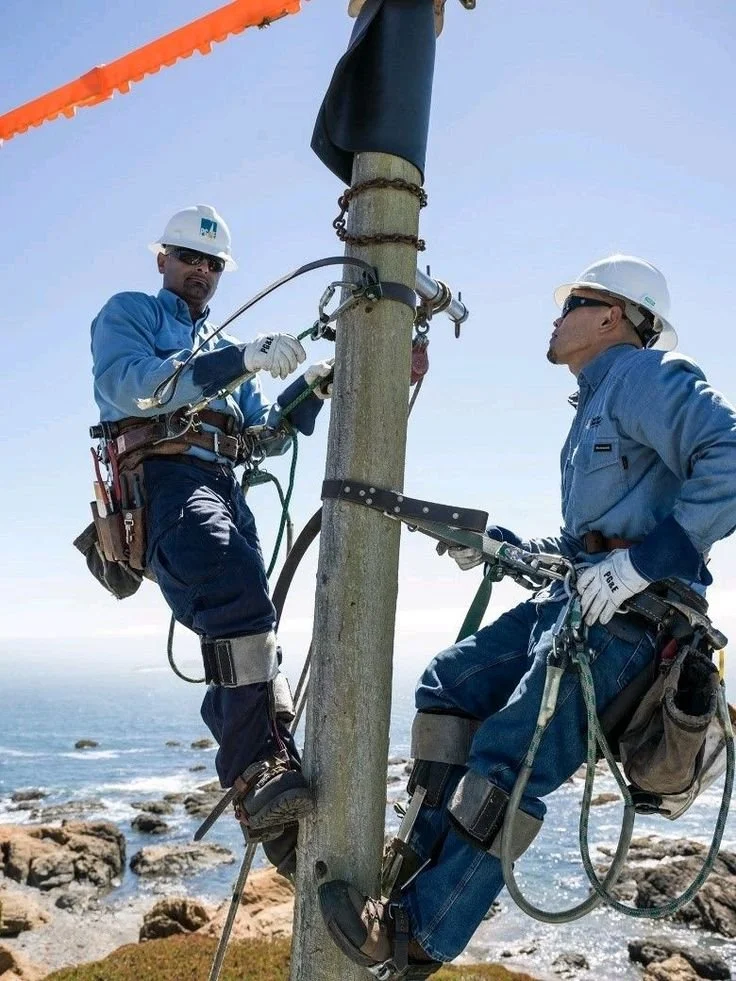

As a former blue-collar worker, I know firsthand how critical real, practical benefits are for hardworking teams. At Valhalla Solutions, we don’t just sell policies—we build customized protection plans that actually work for your business and your employees.

Whether you need short-term disability coverage to bridge gaps after an injury, long-term disability security for chronic conditions, or life insurance to protect families, we take the time to:

✓ Listen to your unique needs (no one-size-fits-all solutions)

✓ Explain options in plain English (no confusing jargon)

✓ Design affordable packages that balance employer costs and employee value

✓ Stand by you at claim time (fast approvals, no runaround)

Our Services

-

Bridge the Gap During Recovery

When employees face illness or injury, our short-term disability plans provide essential income replacement (typically 50-70% of salary) for 3-6 months.

Key features:

Fast claims processing (benefits start in as little as 1-2 weeks)

Flexible elimination periods (0-14 days)

Coverage for pregnancies, surgeries & non-work injuries

Voluntary or employer-paid options

Ideal for: Businesses wanting to minimize productivity loss while supporting employee wellbeing. -

Protect Livelihoods When It Matters Most

Our long-term disability solutions safeguard employees facing extended absences (2 years to retirement age) with:

Monthly payouts up to 60% of pre-disability earnings

Own-occupation coverage (pays if they can’t work their specific job)

Cost-of-living adjustments (optional rider)

Mental health & chronic condition coverage

Be Proactive: 1 in 4 workers will experience a disability lasting 90+ days.

-

Financial Security for Families, Peace of Mind for Employers.

Offer tax-advantaged life insurance that helps employees protect their loved ones:

Guanteed-issue coverage (no medical exams for basic amounts)

Portable policies (employees can keep if they leave)

Accidental death & dismemberment (AD&D) riders

Spouse/child coverage options

-

Lump-Sum Payouts When Facing Serious Diagnoses

Help employees manage costs after cancer, heart attacks, strokes with:10,000−10,000−100,000+ tax-free payments

25+ covered conditions

Wellness program integrations (preventive care discounts)

Comprehensive Services

As your employee benefits broker, we provide a wide range of services to ensure the smooth and effective management of your benefits plans:

Compliance Support: Ensuring your benefits programs meet all federal and state regulations, including the Affordable Care Act (ACA) and ERISA.

Open Enrollment Support: Assisting with the entire open enrollment process, from employee communications and meetings to online enrollment platforms.

Claims Assistance: Helping employees resolve claims issues promptly and effectively.

Employee Education: Offering resources and support to help your employees understand and maximize their benefits.

Vendor Management: Coordinating with multiple vendors to ensure seamless plan administration.

Cost Analysis: Conducting regular reviews to identify cost-saving opportunities and recommend plan adjustments.

Get Started Today

Whether you’re enhancing your existing benefits or starting fresh, our team is here to simplify the process, save you money, and provide peace of mind.

Contact Us Now

Let’s discuss how we can transform your employee benefits program! Reach out to us to schedule a consultation.